Safe harbor 401k calculator

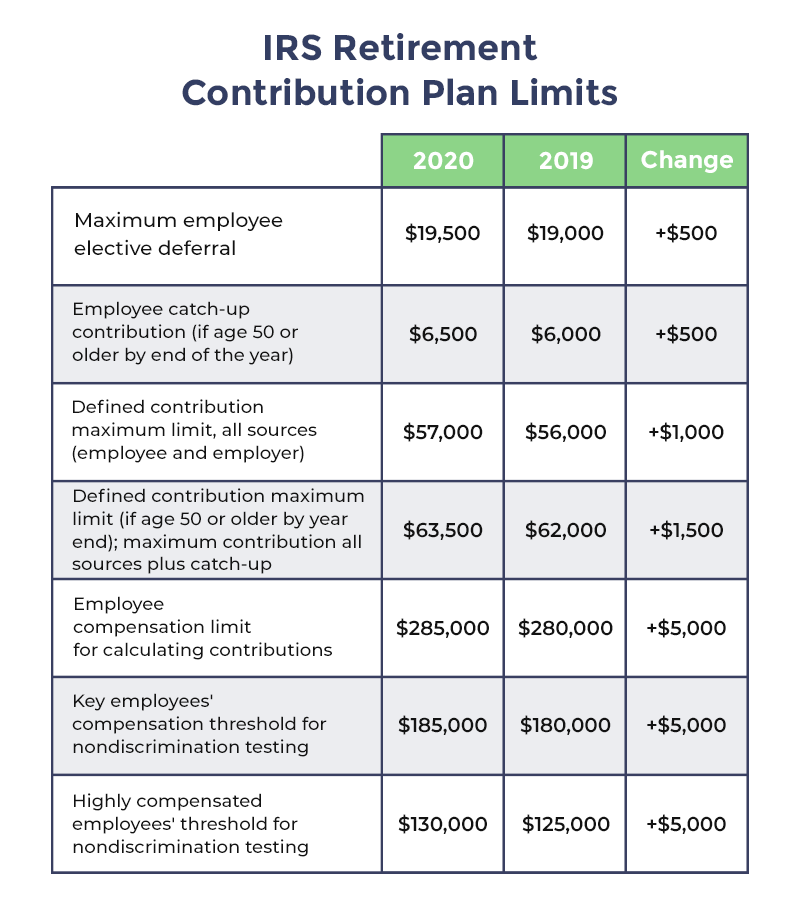

If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit or 27000. Use our free calculator to help you plan for retirement.

How Much Will I Get If I Cash Out My 401 K Early Ubiquity

Everyone of our Harlandale Friends.

. One Participant 401k Plans One-Participant 401k Plans More In Retirement Plans. For instance a company with 10. Second safe harbor 401ks can help boost participation in your companys retirement plan across your company.

We offer Roth 401k Safe Harbor 401k. Users should consult a tax professional regarding specific tax needs. Florida lottery archives December 24 2021 fidelity 401k login app.

Replika is an AI that you can form an actual emotional connection with - and decide whether you want your Replika to be your friend romantic partner or. How to access msconfig in safe mode. Click for more info.

Our low-cost 401k plans are easy to setup online and are supported by our 401k advisors and specialists. 401k Simple IRA SEP IRA 401k plans and investment choices. The full score of services will expand to specialized TPA products available to all unbundled 401k recordkeepers.

Replika is a 1 chatbot companion powered by artificial intelligence. Our most customizable 401k for business owners who want to maximize savings and receive dedicated support. So why would someone select a safe harbor 401k plan over a traditional 401k.

ShareBuilder 401k serves small business and medium-sized companies as well as the self-employed. Start a Safe Harbor 401k Retirement Plan by October 1 and be eligible for tax benefits. Safe Harbor Deadline.

Join millions talking to their own AI friends. Your 401k plan is paired with investment management expertise and. Non-safe harbor employer match and profit sharing contributions can be distributed at any age.

These accounts are 100 vested and must be funded on a per-pay-period basis. Mccreary funeral home obituaries. Mid-year Amendments to Safe Harbor 401k Plans and Notices.

Lux to dli calculator. This calculator is for illustration purposes only and should not be construed as tax advice. 401k Checklist PDF Helps you keep your 401k plan in compliance with important tax rules.

ADP offers a handy calculator on their website to estimate your baseline 401k costs. Plan is a safe harbor plan or other plan exempt from testing. Your plan may also permit while you are still employed safe harbor hardship distributions from your 401k for certain medical expenses college tuition or funeral expenses.

And weve already talked about how your HCEs can max out their. Terminate a 401k Plan Additional resources for 401k Plans. A seamless Safe Harbor 401k for small businesses that want to make an employer contribution.

If you excluded eligible employees from your 401k. We offer Roth 401k Safe Harbor 401k Traditional 401k and Solo 401k options. Plus get two months FREE on plan feesLearn More.

Safe harbor plans automatically satisfy certain IRS nondiscrimination testing requirements. 123movies reddit safe. Raytheon products September 1 2021 ohio state university application deadline 2023.

A 401k is a qualified profit-sharing plan that allows employees to contribute a portion of their wages to an individual account. If you choose a safe harbor plan with basic or enhanced matching non-HCEs will be encouraged to put money into their 401ks so that they can get the employer match. Safe Harbor 401k Rules.

Correct a 401k Plan. ShareBuilder 401k serves small business and medium-sized companies as well as the self-employed. ShareBuilder 401k is an online-only workplace retirement plan provider.

This plan type is designed to assure that your 401k plan is fair for all employees. 401k deferrals but not their earnings non-safe harbor contributions rollovers and voluntary contributions can be withdrawn in a hardship distribution at any time. With a safe harbor plan employers are required to make contributions to employees accounts but there is some flexibility as to how they are made.

19 is the deadline to maximize tax savings for 2022. Employee rollover and voluntary contributions can be distributed at any time. A safe harbor 401k plan will generally satisfy non-discrimination rules for both elective deferrals as well as employer matching contributions.

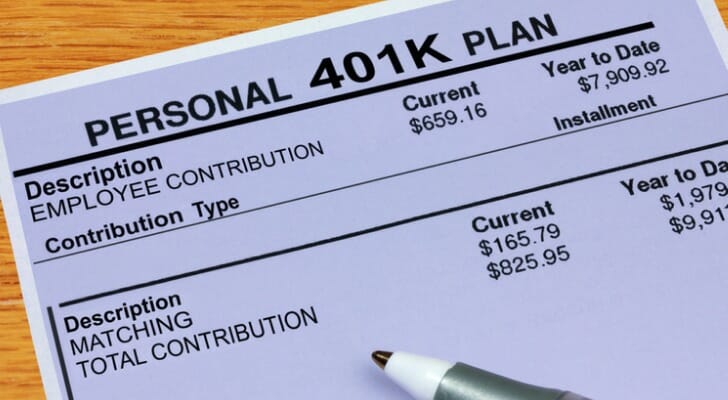

Types of Retirement Plans. The initial plan services launched are solo 401k safe harbor 401k and small business cash balance plans. 401k Employer Match Calculator Many employees are not taking full advantage of their employers matching contributions.

The money can also be used for a down payment repair of damage or costs related to avoidance of foreclosure or eviction from your primary residence. 401k Fix-it Guide Tips on how to find fix and avoid common errors in 401k plans. A 401k for businesses that want the flexibility to pick and choose features to meet their goals.

Safe Harbor 401 K Match Vs Nonelective Two Words For The Same Thing Or Two Different Options

Safe Harbor 401 K Edward Jones

Solo 401k Calculating My Solo 401k Contributions For A Sole Proprietor My Solo 401k Financial

What Compensation Should We Use To Calculate Company Contributions To Our 401 K Plan

How Safe Harbor 401 K Plans Work Smartasset

Safe Harbor 401 K Plans For Businesses Fisher 401 K

Important 401 K Compliance Dates And Deadlines

401 K Income Limits The Mistake Executives Earning Over 305 000 Make All The Time

Looking For Secure Retirement A 457 Plan Could Be The Best Tool For Creating A Secure Retirement Use Our 457 Retirement P How To Plan Finance Blog Retirement

Safe Harbor 401 K How It Works And Protects Your Business Ubiquity

Safe Harbor 401 K How To Avoid This Costly Option

The Ultimate Guide To Safe Harbor 401 K Plans

The Real Deadline For Depositing 401 K Deferrals And What To Do If You Re Late Www Patriotsoftware Com Payroll Software Deposit Employment

Simplified Formula Example 401k Match Youtube

The Big List Of 401k Faqs For 2020 Workest

How Safe Harbor 401 K Plans Work Smartasset

What Is 401 K Safe Harbor Match Ubiquity